|

|||||||

Whitmer’s Budget Proposal Heavy on New Vice Taxes; Rainy Day Fund Withdrawal Gov. Gretchen Whitmer's budget recommendation proposed Wednesday attempts to balance what her administration called "uncertainties" stemming from federal actions with unspecified cuts, $800 million in new revenue from tax increases and $400 million pulled from the rainy day fund. The $88.1 billion budget ($13.6 billion General Fund) includes limited tax relief, some tax and fee increase requests, a pull from reserves and limited new spending, mostly targeted at education programs. The new revenue would come from new or increased taxes levied on tobacco, vaping devices, digital advertising and changes to the online gaming tax structure. Even before the budget presentation began at 1 p.m. in the House Appropriations Committee room, House Speaker Matt Hall, R-Richland Township, told reporters he was not on board with any tax increases or pulling funding from the Budget Stabilization Fund – also known as the rainy day fund. Along with some tax increase proposals, Whitmer is proposing additional funding for K-12 schools with a focus on literacy, property tax relief for seniors and a sales tax holiday on school supplies. Funding for universities, community colleges and local governments remains flat in the proposal. The $21.4 billion School Aid budget ($45.3 million General Fund, $18.55 billion School Aid Fund) includes a 2.5% increase in the foundation allowance, bringing spending to $10,300 per pupil. It also includes funding for literacy improvements. "Michigan is open for business and on the move, and this budget will deliver on the kitchen-table issues that make a real difference in people's lives," Whitmer said in a statement. "My balanced budget proposal will build on our strong record of bipartisan success. It doubles down on shared, long-term priorities to create good-paying jobs, fix roads, save Michiganders money, and ensure every child can read, eat, and succeed. Let's work together to deliver another balanced, bipartisan budget on time and keep moving Michigan forward." The 2026-27 fiscal year budget officially kicked off on Wednesday as Budget Director Jen Flood presented before a joint meeting of the House Appropriations Committee and the Senate Appropriations Committee. Whitmer did not attend the final budget presentation of her tenure and did not address the proposal to reporters on Wednesday. Entering the 2026-27 fiscal year, Flood said the state is facing a $1.8 billion gap due to declining revenues, rising health care costs, federal changes in the One Big Beautiful Bill Act, persistent inflation and "critical investment needs that we cannot responsibly ignore." Heading into the next fiscal year, the state is facing new requirements outlined by the federal government: Medicaid and Supplemental Nutrition Assistance Program work requirements, twice-yearly redeterminations for Medicaid and an increase in the cost share for SNAP from 50% to 75%. The Whitmer administration said it will cost the state $186.6 million to meet the "burdensome" new requirements, citing proposals or policies already enacted in other states similarly responding to the federal changes. "As you can see here, we're proposing a responsible mix of new revenue, reductions and efficiencies, and drawing from reserves to deliver a budget for the next fiscal year that benefits all Michiganders," Flood said. "In short, we're confronting the numbers strategically and making deliberate choices to preserve what matters most. By focusing our resources thoughtfully, we can protect core services, strengthen infrastructure and make targeted investments that help our communities thrive even in the face of ongoing fiscal pressures." After a protracted budget process in 2025 – the budget was not finalized until after the 2025-26 fiscal year began – there already appeared to be broad disagreement on Wednesday between the Democrats, who control the administration and the Senate, and Republicans in charge of the House. The dynamic heading into the 2026-27 fiscal year is different than a year ago, however, with the Legislature up for reelection along with the governor's office, secretary of state, attorney general and the open U.S. Senate seat. Senate Appropriations Chair Sen. Sarah Anthony, D-Lansing, said she is recommitting herself to being professional ahead of upcoming budget negotiations, which may involve some difficult conversations. "We have 140 days to pass a bipartisan budget, to get it to the governor's desk, within the allotted time that the law requires," Anthony said. "While we did pass a bipartisan budget last year … I think we would be kidding ourselves if we thought last year was a successful process. We did not meet our statutory deadline. We left local governments, we left school districts, we left nonprofits and the business community with uncertainty, with chaos, with unprofessionalism, sometimes with name calling, that was below the institution. That was beneath us as professionals and as lawmakers." Republicans argued Whitmer is being irresponsible and officials weren't prudent with dollars they received from the federal government during the COVID-19-era. Democrats said the federal government has left states holding the bag with changes to Medicaid and food benefits along with tariff policies. The $800 million in new revenue from tax increases under the proposal would come from increasing taxes on tobacco ($232 million), vapes and non-tobacco nicotine products ($73.6 million) and digital advertising ($282 million). The budget also proposes updating the state's internet gaming, sports betting and online gaming tax structure ($192.8 million). House Appropriations Chair Rep. Ann Bollin, R-Brighton, said she was not excited about all the increases, but looks forward to working together. "I absolutely think it's premature to think we need any kind of revenue increases," Bollin told reporters. "I think what we have to do is set our priorities and make sure that we are looking … where the excesses are." Sen. Jon Bumstead, R-Norton Shores, minority vice chair of Senate Appropriations, said residents are working hard to stretch every dollar and the state should do the same. Bumstead said he welcomed the openness on tax relief, but that he has "never been a fan of offering relief to only specific groups." "Tough conversations are needed on how we balance the budget," he said in a statement. "Taking money from the budget stabilization fund to support her liberal agenda instead of taking a deeper look at what can be cut or offset in other places is bad for all Michiganders." The budget also includes proposals from recent budget cycles that Whitmer has been unable to see across the finish line: an increase in tipping fees, an increase in Game and Fish fees and reducing the foundation allowance for cyber schools. The conservative Michigan Freedom Network also panned the budget proposal, saying the governor's solution to revenue shortfalls is to increase the overall spending plan. "After seven years of bad budgets, our expectations could not have been lower," Gabe Butzke, a spokesperson for Michigan Forward Network, said in a statement. "Still, Gretchen Whitmer managed to disappoint us. She is either wholly unaware of the problems Michigan families are facing, or she simply doesn't care." Americans for Prosperity Michigan and the National Federation of Independent Business Michigan also criticized the budget proposal. Michigan League for Public Policy President and CEO Monique Stanton in a statement said Whitmer's final budget recommendation includes several "important priorities that will help lift up Michiganders, safeguard them from financial strain and mitigate the harm caused by reckless federal cuts to important programs." "The governor's proposal to strengthen Medicaid funding through tax increases on gaming as well as vaping and tobacco products is a win-win for the health and well-being of Michiganders," she said. "It's a smart solution that will help close this year's $1.8 billion hole created by last year's federal megabill, and it will help protect access to health care for families, children, seniors and people with disabilities across the state at a time when that protection is very much needed due to the federal funding cuts. At the same time, we hope the new tax on vaping and tobacco products will reduce consumption of these products that have caused significant harm to the health of our state's people, including Michigan youth and young adults." Whitmer is also proposing $351.8 million to increase direct care worker wages to $18.40 per hour for the lowest paid workers and to remain in line with the state's minimum wage and paid sick leave requirements. The state will see more spending on roads under the budget proposal after lawmakers and the governor enacted a new funding plan last year. The budget includes $100 million to repair local bridges, $100 million for transit and $481 million for general road improvements. Finally, the budget proposal included requests for a 2025-26 fiscal year supplemental, including $150 million for strategic site readiness, $450,000 in federal funds for arts programming, $1 million to kickstart work by the office of Future Mobility and Electrification, $750,000 for qualified historic buildings in rural communities and $6.5 million to acquire forest land in the Keweenaw Peninsula.  Federal Squeeze on Medicaid Prompts New Revenues, Other Changes to Maintain Coverage Federal Squeeze on Medicaid Prompts New Revenues, Other Changes to Maintain Coverage

Gov. Gretchen Whitmer is hoping to stave off cuts in Medicaid coverage through a series of tax increases and a to be determined replacement tax on health insurers. On paper, Whitmer's proposed budget for Department of Health and Human Services for the 2026-27 fiscal year looks like a dramatic increase, going from $30 billion ($7.1 billion General Fund) to $50 billion ($7 billion General Fund), which is a 36.5% increase overall from the current year. But in reality, the governor is proposing essentially the same amount of spending. In the current year – amid uncertainty in what the new federal rules on the One Big Beautiful Bill Act would mean for the state's provider taxes levied on insurance and health providers to receive additional federal Medicaid funds, the state parked about $9.3 billion in reserve. About two weeks ago, the federal Centers for Medicare and Medicaid Services published a final rule saying Michigan could continue to use its provider taxes through Sept. 30, 2026. After that, if the state wants to continue its Insurance Provider Assessment, it will have to use a new model that complies with federal rules. A law enacted last year allows the Department of Health and Human Services to design and implement a new tax. Whitmer's budget proposal did not reveal details of what that would look like, but it does say her budget is built on the assumption that tax generates $579.3 million in revenue. The other critical component to keep Medicaid whole is about $800 million in tax increases Whitmer proposed (see separate story). "Those things are becoming real for us. And they're going to become even more real in 2028 and beyond," Budget Director Jen Flood said of the federal Medicaid reductions. "We know that Michigan's Medicaid program is one of the most cost-effective and efficient in the country. New spending was relatively small for the large budget, $94.3 million General Fund to offset a reduction of the same amount in federal funds for SNAP administrative costs and $80.3 million ($54.2 million General Fund) to add 589 full-time equivalent employees to address workload increases resulting from the federal OBBBA. Hiring would be targeted for assistance payment workers, Office of Inspector General agents, departmental analysts, supervisors and administrative assistants. Whitmer's budget continues wage increases for direct care workers. The previous 2025 and 2026 increases totaling $3.40 per hour would continue, and then the budget proposes a $1.27 raise that would cost $69.5 million ($23.5 million General Fund). There would be a $10 million one-time increase designed to improve staffing levels in nursing homes by using civil monetary penalty funds. DHHS Director Elizabeth Hertel told Gongwer News Service after the presentation to a joint meeting of the House and Senate Appropriations Committee s that she was encouraged to see a continued focus on maintaining Medicaid in the governor's proposal. In response to worries that House Speaker Matt Hall, R-Richland Township, could be adversarial to the tax increases to backfill losses to Medicaid through the federal budget bill, Hertel said it was just the first day and "there's a lot of conversations to come." Hertel also said the increased budget would "address a lot of what we're facing" with federal cuts and she said the proposed minimum wage increases "are putting appropriate focus on the quality of care that direct care workers do." The big unknown is how DHHS will design the new Insurance Provider Tax to raise $579 million, said Dominick Pallone, executive director of the Michigan Association of Health Plans. "It's kind of an open question," he said. "They are counting on a large revenue from the IPA in fiscal year 2027." Pallone praised the governor for seeking new revenues to support Medicaid. "From our perspective, we definitely appreciate the governor proposing new revenue dedicated to Medicaid," he said. "We need revenue in the Medicaid Trust Fund. No doubt about it." But questions about legislative support raise the question of "then what" if the new revenues don't pass, he said. House Appropriations Chair Rep. Ann Bollin, R-Brighton, said she was concerned about Medicaid, but she wasn't convinced new revenue was the way to go. "I'm not really excited about all of the increases," Bollin said. "I do have concerns about Medicaid, but I look forward to moving ahead, working together with the Senate and the exec to deliver a sustainable and responsible budget for Michigan taxpayers. I have a different opinion on what they're seeing is coming down from the federal government." Other groups had varied reactions. Brian Peters of the Michigan Health and Hospital Association said the organization appreciated the governor putting a priority on Medicaid. Laura Haynes, president and CEO of the Michigan HomeCare & Hospice Association, warned the proposed new revenue will not fully offset the shortfall triggered by federal changes. Absent full replacement, home- and community-based care providers will be unable to sustain services at current levels, Haynes said. "Home-based care providers already face intense workforce shortages and rising costs," she said in a statement. "If we do not fully fund Medicaid with real, long-term resources, we risk deepening access disparities in rural and underserved communities while shifting costs to hospitals and other parts of the health care system that are already strained. As lawmakers continue the budget process, MHHA urges them to ensure that the final FY 2027 budget addresses the full Medicaid funding shortfall, protects reimbursement rates that sustain access to home-based care, and prioritizes services that allow patients to remain in their homes whenever it is medically appropriate." Monique Stanton, Michigan League for Public Policy president and CEO, praised the new revenue to support Medicaid. "The governor's proposal to strengthen Medicaid funding through tax increases on gaming as well as vaping and tobacco products is a win-win for the health and well-being of Michiganders," she said. "It's a smart solution that will help close this year's $1.8 billion hole created by last year's federal mega-bill, and it will help protect access to health care for families, children, seniors and people with disabilities across the state at a time when that protection is very much needed due to the federal funding cuts."

The governor's budget recommendation for the Department of Environment, Great Lakes and Energy is focused on infrastructure, water resources and once again proposes an increase in the state's tipping fees to generate new revenue. "Michigan's natural resources – our air, our land and water – are essential to safe and healthy communities," Kyle Guerrant, deputy state budget director, said to the joint members of the House Appropriations Committee and the Senate Appropriations Committee . "This budget continues to invest in protecting them." Gov. Gretchen Whitmer's proposed 2026-27 fiscal year budget for EGLE comes in at $965.8 million ($106.8 million General Fund). Whitmer's recommendation cuts $64 million in one-time funding from the department's 2025-26 budget. Overall, the executive recommendation decreases the EGLE budget by 0.2%, and there is a 36% decrease in General Fund dollars. This year, Whitmer once again proposed an increase on the tipping fees paid for landfilling trash from other states. The goal, the administration said, is to bring the fee in line with other states in the Midwest and reduce the economic incentive for other states and Canada to ship their garbage to Michigan. Similar proposals died under the Democratic trifecta during the 2024-25 budget cycle and died again last year under divided government. Like in previous years, Whitmer's tipping fee proposal would increase the solid waste surcharge from $0.36 to $5 per ton and would generate $80 million in new revenue. Of that, about $52 million would be dedicated to environmental cleanup and redevelopment through the brownfield redevelopment program and emergency contamination response. Another $17.6 million would go toward recycling initiatives, materials management planning and recycling market development. The remaining $10.4 million would support waste management by expanding programs that conduct landfill oversight, monitoring closures and corrective actions. The proposal would also remove income tax revenues to the Renew Michigan program. House Appropriations Committee Chair Rep. Ann Bollin, R-Brighton, said the proposal was unlikely to make it into the final budget. "We all talk about trying to make it more affordable for Michigan families, and an exponential increase on tipping fees is not helping Michigan families at all," Bollin said. "That's a high cost, and we can't burn garbage here in most of the state. … You've got to put it out at the curb." Bollin said, despite that, the House would review the proposal through the subcommittee process. "We'll start the conversations with our subcommittees and look forward to developing a responsible and sustainable budget that delivers," she said. The EGLE budget also provides $7.3 million in restricted funds for the Water Resource Division by increasing land and water permit fees in line with inflation. The fees have not been adjusted in more than 20 years, the administration said, and the additional revenues will go toward expanding oversight and monitoring Michigan's waterways and water infrastructure. The governor's recommendation also provides $2 million from the General Fund to conduct climate vulnerability assessments in local communities. The studies would be aimed at helping communities plan for climate changes and mitigate their exposure to natural disasters. DCD MUNICIPAL MINUTE: DATA CENTERS  Revenue Sharing Overview for Michigan Municipalities Governor Gretchen Whitmer has released her proposed Fiscal Year (FY) 2027 state budget. The proposal maintains current revenue sharing structures for local governments, with targeted public safety funding continuing but no broad increases to core municipal revenue sharing. Statutory Revenue Sharing

Constitutional Revenue Sharing

Public Safety Revenue Sharing

Financially Distressed Communities

What This Means for Municipalities

Bottom line: The FY 2027 executive budget proposal preserves existing revenue sharing programs but does not significantly expand unrestricted funding for municipalities, instead emphasizing targeted public safety support within the current fiscal framework.

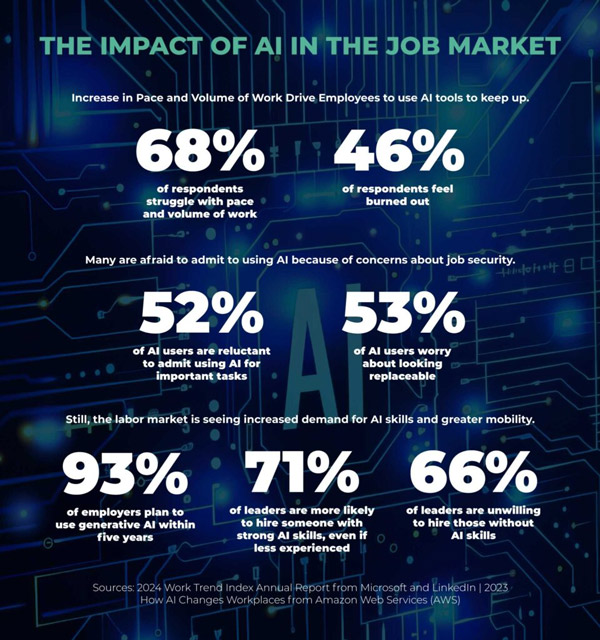

AI & Michigan Jobs: What to Know Now

DCD IS A FULL-SERVICE, BI-PARTISAN, MULTI-CLIENT LOBBYING FIRM REMEMBER ALL OF DCD'S SERVICES: ARTICLES OF POLITICAL INTEREST:

Lobbyists spent record amount on free meals for Michigan lawmakers in 2025 - Bridge Michigan West Michigan faces job losses and uncertainty, as economy takes toll - Bridge Michigan Report: Michigan-Canada bridge delay could cost up to $7M per week - Bridge Michigan 3 Michigan Democrats test vision of affordability in the Senate primary Detroit’s ex-mayor bets that Michigan voters are sick of party politics PARTING WISDOM:  Doing Things Differently DCD is rebranding, and our bottom line is your bottom line. We are striving to create and foster strong relationships with clients and lawmakers, deliver results with strong ethics and class, but above all else, out-hustle and out-smart our competition every day to be the very best. We’re making chess moves while others are playing checkers. Everything we do is with you in mind, we’re doing things we’ve never done before and aggressively pursuing opportunities. The time is now. DCD has taken our firm to the next level and your involvement and investment paired with our knowledge and expertise is going to launch the great state of Michigan forward. |

|||||||

|

|||||||

|

Landfill Tipping Fee Proposal is Back for Round Three in Exec Rec

Landfill Tipping Fee Proposal is Back for Round Three in Exec Rec